You are currently browsing the category archive for the ‘Baby Boomers’ category.

Right now I’m living in a multigenerational home with my eldest daughter, son-in-law, 2 grandchildren, 1 friend renting the basement flat, 2 dogs & 3 cats. Even though this was thrust upon us unexpectedly, it has worked remarkably well. There are many advantages including all the hugs that I get everyday-something that I had been missing during Covid-19 times. If you know me, you know that I AM a hugger & very independent. I need the variety of ages, conversations & projects going on everyday. I have to admit that I am the instigator of some of the cooking, baking, gardening & art projects and I am able to help the household with other projects. I truly love spending this precious time with my family that one doesn’t get when one only sees them once or twice a year. Because of them I am surviving, if not thriving, during these difficult times. I am learning so much from my family & hopefully, they are learning something from me.

Multigenerational homes had been very common in the USA until modern industrial times but they are still & have been very common in Europe for hundreds of years-especially in Germany (Großmutters Haus), France, Italy. This trend is growing again in the United Kingdom as one in eight UK homes expects to feature granny flats

A few good points-You can share financial & home maintenance responsibilities, share cooking time & increase security but most importantly to me-strengthen the family bonds.

Do you think a multigenerational home is in your future or is there one you’d like to be in your past? Whether you’re looking for a home for your whole family or your empty nest, let’s find it. I’ll be glad to help you.

Are you planning to welcome an aging parent or in-law into your home? While you may be worried about how your immediate family will adjust, the move will most likely be toughest of all for your Mom or Dad. Keep in mind that giving up one’s independence is one of the most difficult decisions a person can make. And no matter how unsafe or untenable their current living situation may be, it’s still home, and parting will be extremely emotional.

Here are some ideas for smoothing the transition for everyone involved.

- Choose a space carefully. While you may think you picked out the perfect room for your parent, consult with them first. They may have needs and preferences you haven’t even considered, such as an attached bathroom for privacy. In just about all cases, an entry-level room is a must, even for the healthiest of seniors.

- Make room for what matters to them. You may think that spiffing up the room with a new flat-screen TV or walk-in closet would be something your parent or in-law would love, however, a sunny spot for your Mom’s orchid collection may be way more important to her. Being able to continue the small pleasures from their former life will go a long way toward making Mom or Dad happy under your roof.

- Enlist caregivers. While you may be gung-ho to step up and start caring for your parent, it may be the last thing they want. For many seniors, privacy and dignity is paramount and they would much rather have an aide tend to their needs instead of their child. Discuss this openly with your parent and make the necessary arrangements.

- Be clear about money matters. Make no assumptions about the financial arrangement that will take place once Mom or Dad moves in. If they are able and willing to contribute monthly, set up a finite amount in advance. This will help you avoid uncomfortable discussions about paying for groceries, chipping in for rent, etc. In addition, make sure all of your parent’s personal bills are in order and scheduled for automatic payments before they move in.

- Remember, everyone needs space. You may be looking forward to being one big, happy family under the same roof, but remember that everyone needs their private time, most of all your parent. Don’t be shy about retiring early to your room to settle in with a good book, going for a long walk, or out for a date night. Mom or Dad will most likely welcome the chance to have their own alone-time, too.

According to International Living’s newly released Annual Global Retirement Index for 2019, the world’s top 10 retirement destinations are:

#1 Panama #6 Colombia

#2 Costa Rica #7 Portugal

#3 Mexico #8 Peru

# 4 Ecuador #9 Thailand

#5 Malaysia #10 Spain

By Jim Santos, IL Coastal Ecuador Correspondent

https://internationalliving.com/the-best-places-to-retire/

Nearly three decades have gone by, during which our scouts have scoured every corner of the globe many times over. The result is a much bigger and ever-growing selection of outstanding destinations where you can live a healthier and happier life, spend a lot less money, and get a whole lot more.

But how do you choose? The Retirement Index is still the most comprehensive and in-depth survey of its kind. It’s the best way we know of to sift through the wealth of opportunity the world offers, bring some order, and help you pinpoint the best destination for you.

Annually we reflect on and refine our methodology. This year is no exception, and we’ve made some changes. The research and production of the Global Retirement Index is now an annual rite involving every single member of the International Living team. That team has grown to cover five continents, which means we’re bringing to the Index an ever-greater depth of knowledge.

A vast amount of hard data goes into the Index. It’s a distillation of every pertinent and measurable fact our scouts and experts can lay their hands on. And it reflects the experience of every expat who has contributed to International Living since the publication of our first issue, 40 years ago.

But don’t think of it as a mere number-crunching exercise. At its heart lies the good judgement of our far-flung editors and correspondents. We didn’t create this Index for it to be a purely objective resource. Yes, it is built on hard facts. But its power—its utility—lies in what we recommend you do with them. In other words, we bring our team’s good judgement to bear on the question: Where should I go? We share with you their measured opinions and recommendations. We don’t just tell you what the situation is on the ground—we help you figure out what it means for you.

Having moved overseas and immersed themselves in the destinations where they live and learned their lessons the hard way, our experts are ideally placed to compare, contrast, and bring nuanced insight to the most appealing retirement destinations in the world.

What has their research revealed about the best retirement havens in 2019? Read on…

10. Spain

By Glynna Prentice, IL Editor

Spain is one of Europeans’ favorite “beach destinations.” It offers First-World, Western European living standards, so there’s no question of having to “give up” anything in living here. In fact, you’ll gain a lot. Outside the tourist zones, you’ll need to know Spanish to get by. But there are plenty of beach areas with large, English-speaking expat communities.

Cool northern provinces like Navarre, Cantabria, Asturias, Galicia, and the Basque country offer forests, mountains, friendly locals, and food to die for. My favorites include little Vitoria-Gasteiz, capital of the Basque country, and Pamplona, in Navarre (although avoid the San Fermín festival, with its famous running of the bulls, in early July).

Because of the warm climate, many basic food items are inexpensive here—Spain produces a variety of fruits and vegetables both for domestic consumption and for export. In season—and Spain has a long growing season—many produce items cost around 60 cents a pound. In addition, many fruits and vegetables that are relatively gourmet items in North America—baby artichokes, cherimoya, and doughnut peaches, for example—are locally grown in Spain.

Following Spanish eating habits will also keep costs down. Lunch is the big meal of the day, and the lunch special, or menú del día, is a great bargain. For anywhere from $11 to $20, you’ll get two to three courses, plus a beverage (which can often be beer or wine). Make that your big meal out (or prepare it in your rental) and follow it with a light dinner or tapas.

With one of the lowest costs of living in Western Europe for around $2,500 a month, a couple can live comfortably in many parts of the country.

Traveling by rail in Spain is fast and efficient to large and medium-sized cities. I travel about Spain, discovering new haunts, revisiting old ones, and catching up with friends around the country.

Spain also has a surprising range of climates, from hot and dry in the south to cool and mild in the north. There’s skiing, too—not just in the north, in the Pyrenees, but down in the mountains of the south, as well.”

In terms of healthcare The World Health Organization ranks Spain as having one of the best healthcare systems in the world. The public system is widely used. But it also has great private healthcare, including 29 JCI-accredited facilities.

Spain is one of the most tolerant places I know of for those with alternative lifestyles. Civil unions, as well as marriage, are recognized by law. And same-sex marriages have been legal there since 2005. And as a single woman, I’ve always felt safe there. It’s a late-night culture, so people are out and about at all hours.

9. Thailand

By Rachel Devlin, IL Chiang Mai Correspondent

Southeast Asia offers some of the world’s most attractive retirement programs, astounding geographic and cultural diversity, and climates to suit all tastes, ranging from hot beach resorts to cool highland hill stations. You’ll find sophisticated cities, ultra-modern, affordable healthcare, and luxury accommodation for a fraction of North American prices.

Nestled between Myanmar, Laos, and Cambodia, Thailand enjoys the warm-water coastlines of both the Andaman Sea and the Gulf of Thailand. This is a country that has never been colonized by any Western or European countries, so Thai culture is untouched, rich, and ancient. What’s more, it’s ideal for expat living.

My husband, Mick, and I retired in Chiang Mai two years ago, and we even brought our 16-year-old son along for the adventure of a lifetime. We sold our house and cars and set off for a better life. And we found it.

Rentals here can be as little as $400 per month for a modern studio apartment. Utility bills are also significantly cheaper. Imagine paying a monthly water bill that is only $32.

“I order most of my shopping online and get it delivered for free, and that includes cleaning products. It generally costs $45 every two weeks. Sometimes I go to the local market and spend $4 on armfuls of fresh fruit and veggies,” says Raelene Haines.

Thailand generally has a tropical humid climate. No cold winters here. Perfect for people who like swimming and sunshine. Arthritis sufferers find great relief in this climate.

There are many modern private hospitals in Thailand. Doctors practice with current medical knowledge and general practitioner visits can cost as little as $10.

For expats with a wandering spirit, travel within the country is inexpensive. A flight of two hours can take you from one end of the country to the other for as little as $100 round trip. Float freely in a long-tail boat or go swimming at beaches from Hollywood movies. Then, within a few hours, you can be in the northern Thai jungle, drinking a cocktail in an infinity pool overlooking rice paddies and ancient temples.

As a home base, Thailand is well situated. On average, it only takes an hour-and-a-half to fly to anywhere in Southeast Asia.

If you worry about finding friends in Thailand, have no fear. Expat communities are alive and busy. You will find meet-ups taking place regularly, and lots of local interest groups. If you want to maintain an active lifestyle by joining a gym, hiking, or biking, or if you prefer to dive into history and art, it’s all here. There are hundreds of Facebook pages dedicated to expat interest groups, so finding your tribe is not difficult. The most enjoyable parts of Thai culture revolve around the idea of sanook (meaning “fun”). Whatever you find yourself doing, you are encouraged to make it fun and enjoy every minute.

8. Peru

By Steve LePoidevin, IL Peru Correspondent

While 95% of people who visit Peru do so to explore Machu Picchu, many have discovered an ideal retirement destination, with miles of beaches, delicious cuisine, and some of the lowest costs anywhere when it comes to enjoying a high-quality lifestyle.

My wife Nancy and I moved here just over two years ago, and we love the 300 days of sunshine a year and the highly affordable lifestyle. The cost of living is one of the cheapest anywhere with rents starting as low as $150 per month and filling three-course lunches starting at $2.50, including a drink.

Other than the upscale neighborhoods in Lima, Peru is a very inexpensive place to live. A couple can easily live on a budget of less than $2,000 a month in most regions of the country. Although we choose to spend more (think $2,000 to $2,400 a month).

We love to eat, and Peru has great food wherever you go. From the cevicherias of Huanchaco to the picanterias of Arequipa, you can find a wide variety of inexpensive dishes based on diverse ingredients from the sea, mountains, and jungles of the country.

Fresh fruits and veggies are available year-round at low cost. We pick up enough for $5 at the local market in our home town of Huanchaco to last us a few days.

Spectacular Macho Pichu, Cusco, and the Sacred Valley of the Incas have always been major attractions for tourists, but more expats are now heading to this area for long-term stays and retirement. Nights are cool, but midday highs can reach the 70s F for much of the year.

We spent our first year in the southern metropolis of Arequipa and discovered that it has a lot going for it. Less than a two-hour drive from the coast, it is easy to escape to the nearby popular beaches during the peak summer months of January and February. And the food is to die for. Arequipa is renowned for its range of high-quality restaurants, wonderful traditional cuisine, and centuries-old colonial center.

The capital city of Lima is home to the largest number of expats. They enjoy some of the best restaurants in the world, a large variety of art galleries and museums, a vibrant theatre scene, and the easily accessible international airport. And for anyone breaking into Peru’s business world, Lima is the place to see and be seen.

Surfers enjoy the year-round waves at seaside towns such as Huanchaco. Located only 15 minutes from Trujillo, the second-largest city in the country, it offers the best of both worlds. Huanchaco has maintained its small fishing town charm despite the annual increase in tourist numbers.

There is not a lot of English in Peru so it is almost a necessity to learn Spanish to fit in in most communities unless you only want to socialize with other expats. But the people are friendly, family-oriented, and more than accepting of outsiders. Putting a little effort into learning the language goes a long way in making new friends.

And, when you are ready for a quick getaway, there are daily scheduled flights to the bordering countries of Ecuador, Colombia, Brazil, Bolivia, and Chile. If you are looking for a country with an inexpensive lifestyle, friendly people, and great food, Peru is worth a look.

7. Portugal

By Tricia Pimental, IL Portugal Correspondent

I’ve lived in Portugal for five years, and as IL Portugal Correspondent, I have shared a lot about what makes this country great. Others agree. “It’s the people,” says expat Molly Ashby, who bought an apartment in Lisbon five years ago. “They’re mellow and very receptive to foreigners.”

It’s true. Locals generally make a sincere effort to make visitors and expats feel welcome. Of course it helps if you speak at least a little Portuguese, but in urban areas like Porto and Lisbon and the multi-national expat region of the Algarve, English works just fine.

Another reason is the affordable lifestyle. Portugal is the second least expensive country in Europe, after Bulgaria. My husband Keith and I find we spend about a third of what we did to live in the States. For example, a simple lunch of soup, main course, beverage, dessert, and coffee runs about $10. You can live a comfortable, although not extravagant, lifestyle for about $2,500 a month.

If you choose to live in Porto in the north, Lisbon, or in the expat beach havens of Cascais or the Algarve, you probably want to bump that up to $3,000. You can, however, keep that lower figure simply by moving 20 minutes away from a city center. Enjoy urban amenities, then head back to the ‘burbs and lower rent.

Rated the fourth-safest country in the world in the 2018 Global Peace Index, Portugal is not only secure, but beautiful. “Portugal is a phenomenal place to call home,” says expat Mike Sager. “Being from Southern California (with near-perfect weather), I had no desire to shovel snow or cook during the summer for the rest of my life.

“I love the lowered level of stress in day-to-day things. You walk through neighborhoods, and on every corner will be a little store or restaurant/bar, and folks will just be hanging out having a cold beer or shot of espresso. The elders are telling stories and the kids are playing soccer across the street. Picturesque and peaceful comes to mind.”

If Portugal’s attributes have convinced you to give it a try, here’s a tip: Begin your test drive in the capital. Lisbon is easy to reach, with direct flights from major cities around the world. English is widely spoken, and comprehensive train, bus, tram, and taxi offerings make it unnecessary to own a vehicle. The city is a cultural cornucopia, with museums and historical sites like St. George Castle and the nearby Palace of Queluz.

6. Colombia

By Nancy Kiernan, IL Colombia Correspondent

Perfect spring-like weather all year was the first thing that drew me to retire to Medellín, Colombia. I had lived my whole life in the northeast, and I never wanted to see or shovel snow again. While not exactly pioneers, my husband and I are two of the growing number of expats who have discovered that they can live a First-World quality of life in a country that’s only now showing up on fellow retirees’ radar.

Colombia is the second most biodiverse country in the world, so you can easily find a climate and environment that suits your taste. If you want hot and tropical, consider retiring to the lovely Caribbean coastal cities of Santa Marta or Cartagena, where crystal-clear water laps against warm, sandy beaches. For those who prefer more temperate climates, then I suggest my adopted mountain city of Medellín, or anywhere in the “coffee triangle” of Pereira, Armenia, and Manizales, where you are surrounded by lush, green mountain scenery.

Getting a retirement visa to live in Colombia is also quite easy. All you need to do is prove at least $750 annual income from Social Security or $2,500 annual income from a private pension or 401K and you are eligible to obtain a visa that is good for three years. Once they arrive, retirees are discovering they can stretch their retirement dollars.

Your cost of living will depend on which part of the country you choose to live and what type of lifestyle you want to have regarding dining out and entertainment. I live in El Poblado, one of the most upscale neighborhoods of Medellin and don’t really scrimp. My cost of living is 60% less than it was when I lived in a small city in Maine in the U.S. Just the fact that I don´t have to pay heating or cooling costs has saved me about $3,400 per year alone.

As we all reach retirement age, access to high quality but affordable healthcare becomes a front-and-center issue. The World Health Organization (WHO) ranks Colombia’s health system at #22 in the world, far better than Canada at #30 and the U.S. at #37. As a retired healthcare executive from the U.S., I know quality healthcare when I see it. The high-tech, world-class care I receive in Colombia does not cost “an arm and a leg.” My premium for public health insurance is only $75 per month, and my co-pay for lab tests, prescription medications, and other services is only $4.

The dark days of Colombia’s past are gone, and it has been transformed into a country that is thriving. One of the best things about the country are the warm, welcoming Colombian people. Don’t let a lack of Spanish keep you from trying out life here. As the expression goes, “You don’t meet a Colombian…you meet the entire family!” Here you’ll always feel part of the community.

5. Malaysia

By Keith Hockton, IL Malaysia Correspondent

My wife, Lisa, and I vacationed in Malaysia in 2008 and at that stage we were taking at least two holidays a year somewhere in Asia. When we got back and did the sums we realised that we could actually live in Malaysia and vacation back home, effectively reversing our situation and saving a heap of money into the bargain. We started to make plans to do just that and moved here to live in early 2010.

Idyllic beaches, islands that seduce the senses, and some of the most pristine ancient rainforests in Southeast Asia—this is Malaysia. And these are just some reasons why I call it home.

Malaysian law is based on the British system and all road signs are in both English and Malay, which makes driving around easy. The unofficial first language of the country is English, so you don’t have to learn another language here if you don’t want to.

A family of six can dine out in a good local Chinese restaurant (10 courses) for less than $5.70 per person, including beer. A men’s haircut costs just $2.16. In Penang, a couple can live comfortably on $1,800 a month, including rent.

As for healthcare, when you compare surgery prices between the U.S. and Malaysia, the benefits are obvious. Just the other day I decided on a whim to have a medical.

I’d never had one done before and as I had a free morning I decided just to pop in to the Lam Wah Eee Hospital. I was already registered and found myself sitting outside a GP’s office not five minutes after arriving. Within an hour I’d had I’d been examined by a doctor, had an ECG and blood and urine tests done, and I was on my way home. The total cost of the visit was just $43. The doctor who had examined me called me later that afternoon with the results. It’s this level of service that makes medical in Malaysia not only an attractive option but also a non-scary one. It’s all so easy.

The other attractive thing for us is the outdoor lifestyle. If white-sand beaches are your dream, you have here more than 878 islands to choose from. Both my wife, and I hike a lot; so living near the Penang Botanic Gardens is a bonus. With all year-round good weather, the temperature in Malaysia averages 82 F, there are over 60 hiking trails for us to choose from. We are also members of The Penang Sports Club and The Penang Swimming Club. The swimming club is five-star facility that offers a 50-meter outdoor saltwater pool, a state of the art gym, the best library on the island, a scuba and sailing section, and a number of restaurants that are heavily discounted for members.

Apartment rentals here are good value and you can choose between sea and mountain views. In Batu Ferringhi, a nice beach suburb, you can rent a three-bedroom, apartment with sea views for as little as $403 per month. The complex has a good gym, 24-hour security, secure parking, tennis courts and at least two pools to choose from.

There are direct flights to the rest of Asia from Penang’s International Airport, which makes getting away for a weekend very easy. Penang to Bangkok in Thailand takes just one and a half hours and can cost as little as $43 return.

4. Ecuador

By Jim Santos, IL Coastal Ecuador Correspondent

For me, the number one thing about Ecuador is that it offers so many different types of places to live; you can have warm weather year-round on the coast, a more temperate climate in the Andes, small village life, big-city conveniences, and everything in between.

Quite simply, some of the best weather on the planet can be found in Ecuador. The unique combination of its position on the equator, the cooling sea breezes from the Humboldt Current, the Andes mountain range, and the Amazon basin have conspired to create a variety of climates. There are beaches that are warm year-round but rarely muggy (and are too close to the equator to ever have hurricanes or tropical storms), and places in the hills where you do not need a heating or cooling system. Lush, green hills and fertile valleys are the norm in Ecuador.

While I appreciate the natural beauty and the mix of indigenous, Incan, and Spanish culture, one of my favorite benefits is the affordable lifestyle. There are few places where living is as affordable in Ecuador. There is something for everyone, regardless of your budget. Consider that you can own a home on a Pacific Coast beach for less than $150,000. Not enough is said about property taxes either—my 2,000 square foot oceanfront condo has a tax bill of less than $300 per year—not per month, per year. Rentals and opportunities to buy in the interior are plentiful and affordable.

Since the land produces excellent food, mostly with year-round growing seasons, prices at local mercados are so low, it is difficult to carry more than $15 worth of fruits and vegetables. Household help is available for $10 to $20 per day, and services like pedicures and haircuts are just a few dollars. No need for heating and cooling bills in most of the country, and you can live most places without a car, paying 30 cents or less for buses, and $2 to $5 for cab rides.

Ecuador is a little unique, in that there are not just a couple of expat communities. There are over a dozen places spread all across the country where you can find North Americans enjoying the laidback lifestyle. Even in areas with few expats, like Loja for example, the Ecuadorians make it very easy to feel welcome and at home.

Mike Herron and his wife arrived in Cuenca in 2015. While excited, they were apprehensive, as well. This was uncharted territory for both of them. Not only were they embarking on a different life, they were doing it in a different country where neither of them spoke the language.

Now, three years later and with the advantage of hindsight, they say that, other than getting married, it was the best decision they ever made. They say the most important part of their new lives is the meaningful relationships they’ve developed with expats and Ecuadorians alike.

“People take the time to connect and get to know one another. It’s common to sit and talk with someone, even someone we are meeting for the first time, over a breakfast or lunch that can last two hours or more. When we walk down the street, it’s not unusual to stop and spend 15 to 20 minutes chatting with someone we know, or even with someone we’ve just met while walking,” says Mike.

3. Mexico

By Don Murray, IL Riviera Maya Correspondent

My wife Diane and I moved to Cancún in 2014. We wanted to retire somewhere close to high-quality healthcare and stunning Caribbean beaches—Mexico was the obvious choice. The country has something for everyone: beautiful, warm oceans, crystal-clear tropical lakes, fertile farmlands, temperate-but-majestic mountains, starkly gorgeous deserts, small towns, or sophisticated cities.

Whether your dream retreat is a graceful colonial home with lavish gardens, a simple beachfront bungalow where you can prop up your feet and watch the tide roll in, or a clifftop villa with sunset views and cool, steady breezes, you are likely to find your dream home in Mexico.

The cost of living is notoriously low. In fact, there are many places in the country where a wonderful life can be had for the price of one monthly Social Security check and this improves even more when you figure the normally favourable exchange rate from dollars to pesos. (A couple can live here for anywhere from $1,500 to $3,000 a month, depending on location—and that includes rent and healthcare.)

I didn’t even realize the host of other benefits that I’d enjoy living in Mexico. Once residency is granted, you can sign up for a national healthcare plan. Mexico offers two national healthcare plans for residents. The one most popular with expats is the Seguro Popular program where annual costs may be only a few hundred dollars for full coverage. If you’re over the age of 60, you may also receive your national senior discount card which opens the door to many discounts on goods and services, often ranging from 10% to 20%.

Because of its geographic diversity, you can also choose your favorite climate: from warm and dry to warm and sultry to spring-like temperatures all year in the Colonial Highlands.

Generally, however, the entire country is warm and mild with small amounts of snow falling only on the highest peaks. A light sweater will add some comfort on the few chilly evenings.

But at heart, what I and most other expats love most about Mexico is the vibrant life and culture. And it’s quite easy to fit in. Popular expat destinations include the Lake Chapala area and San Miguel de Allende as well as most coastal retreats. These areas are brimming with expats who can make a newcomer feel welcome.

“I have lived in and visited many wonderful places in my life. But only two that were magical to me, where I felt an immediate feeling that I belonged there,” says expat Paula Nunes. “San Francisco in the late 1960s. And San Miguel de Allende in 2012.”

“Almost every time you go out, you meet people,” she says. “It’s really easy. People give out cards with their name, email, and phone number. I spend a lot of time with people born here, and it’s great. They’re wonderful. I’m trying to learn Spanish, and my Mexican friends are good about correcting me.”

Paula has lived full-time in San Miguel since April 2016. She bought her home—a two-bedroom, two-and-a-half-bathroom house with two covered outdoor terraces—in the neighborhood of Colonia San Rafael, three years ago.

“When I bought, the dollar wasn’t as strong as it is now. It was at 15 pesos to the dollar,” says Paula. “It was less than $120,000.”

With its friendly locals, world-class restaurant and cultural scene, and its low cost of living, San Miguel has been an expat favorite for decades. And Paula doesn’t see herself leaving anytime soon.

2. Costa Rica

By Kathleen Evans, IL Coastal Costa Rica Correspondent

Costa Rica attracts visitors with its tropical climate; low cost of living; top-notch, affordable medical care; bargain real estate; and natural beauty.

Costa Rica has a stable democracy and a peace-loving culture. They abolished their army in 1948 and pledged that budget to education and healthcare. Often called the “Switzerland of Central America” it is known for its safety, neutrality and good banking system—especially compared to many other countries in the region. The current government is progressive and LGBT rights are respected.

One of the things you hear very often from expats is how warm and welcoming the Ticos (Costa Ricans) are. Overall, they are wonderful people, eager to share the magic of their culture with foreigners. You will also find great communities of expats who will help you through the process of acclimating to new surroundings and language. I joined a girl’s dinner group and quickly bonded with women from all over the world. I found it very easy to make friends since many folks move not knowing anyone and are often looking to forge new friendships.

Nicole Rangel from Texas says “From the moment we stepped off the plane in September 2017 with our five suitcases ready to move to Costa Rica with our two elementary age children, I felt the weight of the world lifted off my shoulders. The community is so supportive of each other and the locals. I pinch myself often because of how lucky my kids are.”

Once you have acquired your residency, you pay between 7% and 11% or your reported monthly income, and the socialized medicine program is available to you. You can also blend public healthcare with a private policy. The country has three JCI accredited hospitals and numerous private clinics. More doctors are also taking the U.S. retired military insurance called Tricare Overseas.

Costa Rica also has an outdoor loving culture – with activities from fishing to golfing to horseback riding to hiking to diving to yoga. Plus, there are less processed foods, and more healthy choices with an abundance of locally grown fruits, vegetables, organic eggs and endless seafood. Most of the people I know who have moved to Costa Rica have shed unwanted weight, are taking less prescription drugs and overall feel better.

And, with a dozen microclimates, there is someplace for everyone to fit your personal weather preferences. Many people love the temperate “eternal spring” climate of San Jose, the capital and all the surrounding Central Valley. Or the dry, hot beaches of Guanacaste, or the lush, green landscape of the jungles in the south.

1. Panama

By Jessica Ramesch, IL Panama Editor

Modern, convenient, and close to the U.S.—not to mention sunny, warm, and welcoming. It’s hardly surprising that Panama topped the 2019 Annual Global Retirement Index. Panama is warm and tropical, but completely outside the hurricane belt. The currency is the U.S. dollar. The tax burden is low. And there’s a large English-speaking population—including a cadre of excellent doctors.

Panama City is a destination for exciting food, beer, jazz, film, golf, tennis, and much more. The lush mountain towns of Panama rank among the best retirement destinations in the world. Our livable, clean, and uncrowded beaches include the popular beach hub of Coronado, the lesser-known gem that is the Pedasí region, and a Caribbean paradise—there is no other word for it—called Bocas del Toro.

The capital of Panama, Panama City, is a cosmopolitan city where you can rent an ocean-view condo for as little as $1,500 a month. It’s also the only First World city in Central America. We’re relatively close to the U.S. and Canada (Miami is about three hours away by plane).

I’m able to live as a single in Panama City on about $2,600 a month, including rent, groceries, utilities, and entertainment. I pay zero income tax here, as revenue earned in other countries is exempt. And you’ll never run out of things to do here. What few people know is that this is also a cultural capital. Panama City is home to active, vibrant communities from all over the world, and every art form is celebrated here.

Leave Panama City and costs are even more affordable. Pedasi, is on the tip of the Azuero Peninsula in the province of Los Santos on the Pacific Ocean. Expat Jim Gault who lives in Pedasi, says “Rents in Pedasi during high season (December through April) can cost more than $750 a month, as demand drives up the prices. But, Pedasi does give you the choice of living on a small budget by making use of the local fresh produce, freshly caught fish of the day, and eating out at typical Panama fondas, you can live well on less on Pedasi.”

One area where Panama excels for retirees is the benefits and discounts it offers. The country’s famed Pensionado Program is one of the best retiree programs in the world today and it’s open to everyone. The program entitles pension-holding retirees to a long list of discounts…and I’m talking across the board. From medical expenses to entertainment, retirees in Panama can seriously stretch their dollars. Like 25% off airline tickets, 25% off your monthly energy bills and up to 50% off hotel stays. ILChiriqui Correspondent Nanette Witmer says, “Many people don’t realize that Panama’s famous Pensionado discounts are by law given to all who qualify by age—expat or Panamanian. When women reach the age of 55 and men 60, they can automatically start using the benefits that the Pensionado provides. By showing your residency card you are entitled to discounts.”

Nanette adds, “Healthcare in Panama is good and affordable for minor problems. Most clinics charge a nominal fee of between $20 and $60 for an office visit. Hospitals in larger cities are all of the state-of-the-art equipment and specialists can be found in any field. Doctors in Panama work one on one, no medical assistants or other staff. You deal directly with the doctor and most prescription drugs are cheaper than in North America.”

A country with surprisingly varied landscapes, Panama is so much more than its modern, cosmopolitan capital city. There are mountain towns boasting cool climates, pine-covered hills, and sweet, Swiss-style cottages framed with bright bursts of bougainvillea. And of course, there are beaches galore, from the white sand gems of the Caribbean, to the many popular and easily accessible beaches of the Pacific.

Interactive Table

The table below presents an overview of the top 10 countries in our Annual Global Retirement Index, in order of highest to lowest. Use the previous and next buttons to view all 25 countries. You can filter countries by the following groupings; Financial, Health, Lifestyle and Governance and within each category sort scores by ascending or descending order.

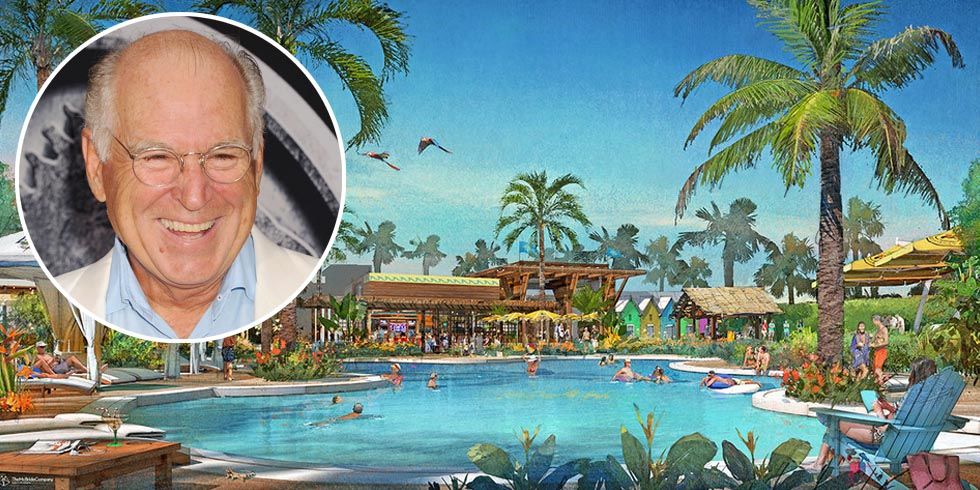

Get your flip-flops ready!! Jimmy Buffet has partnered with Minto Communities to create a community for people 55-and-older in Daytona Beach, Florida which promises to “reflect the lifestyle embraced in Buffet’s songs”.

MINTO COMMUNITIES + GETTY photo

`

Say what? Get your limes & salt shakers out.

The 6,900-home community says it will be tropical & fun.The plans include a pool with cabanas instead of a central park & statue like most towns. Music, food, beverages, an onsite fitness center, indoor lap pool, spa and an outdoor resort-style pool will be the core of this development.

William Bullock, a senior vice president with Minto, told The Daytona Beach News-Journal: “You never know when or where Jimmy Buffett may show up to do a concert. The concept for the community is Margaritaville equals fun,” Bullock said. “Having fun, socializing, enjoying the lifestyle because you’ve earned it, you’ve been waiting your whole life for it and now you’ll be able to celebrate it with food, fun and music.”

The first phase of the Latitude Margaritaville, Daytona Beach, homes are expected to be ready to move into by fall 2018. They’ll feature Old Florida and Key West architectural styles and range in price form the low $200,000s to the mid-$300,000s. They are also going to have some live broadcasts, artists unknown at this time, from there on their SiriusXM Channel.

for more info see http://www.news-journalonline.com/news/20170216/jimmy-buffett-community-coming-to-daytona

by Graham Wood

When we speak of international buyers, we’re usually talking about people from other countries who want to invest in U.S. property. But the lines go both ways. There are high-net-worth Americans who want to buy homes in other countries, and they can spell big business for practitioners who are willing to aid them in their global search. But where should they be looking?

Rick Davidson, president and CEO of Century 21, argued at the Asian Real Estate Association of America’s Global & Luxury Summit in Chicago on Monday that because of the dollar’s strength against many other foreign currencies, American buyers can get great deals abroad. But one country stands above the rest as the best place for Americans to invest their money abroad because of a confluence of economic benefits: Japan.

“We are deeply immersed in the Japanese market,” Davidson said, noting that Century 21 has 900 offices and 6,000 agents there. Here are the reasons Davidson gave for why Japan should be a target for wealthy U.S. home buyers wanting to purchase overseas:

- The interest rates on 10-year fixed-rate loans are 1.5 percent to 1.75 percent — far below America’s historic interest-rate lows.

- One U.S. dollar 119.54 yen, which gives U.S. buyers a 20 percent discount on purchases.

- There are virtually no restrictions for foreign investors in Japan.

- Japan is coming out of recession. Deflation is expected to stop and GDP is expected to grow in the near future, so American investors will start to see a positive ROI starting now.

- Tokyo is the cheapest of all Asian cities in terms of price per square foot. The average price per square foot of a luxury property in the U.S. is $1,180; in Japan, it’s $680.

- Tokyo land prices have been rising for five straight years, making future expectation for price growth high.